Do you hope to find 'ameritrade case study'? You will find your answers right here.

Table of contents

- Ameritrade case study in 2021

- Cost of capital at ameritrade pdf

- Cost of capital ameritrade case study solution

- Ameritrade case study answers

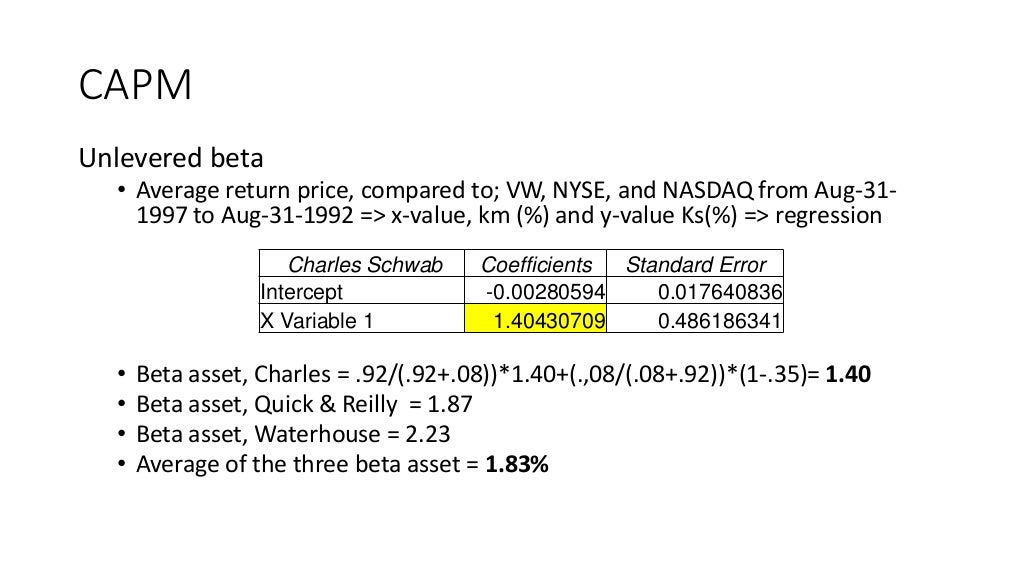

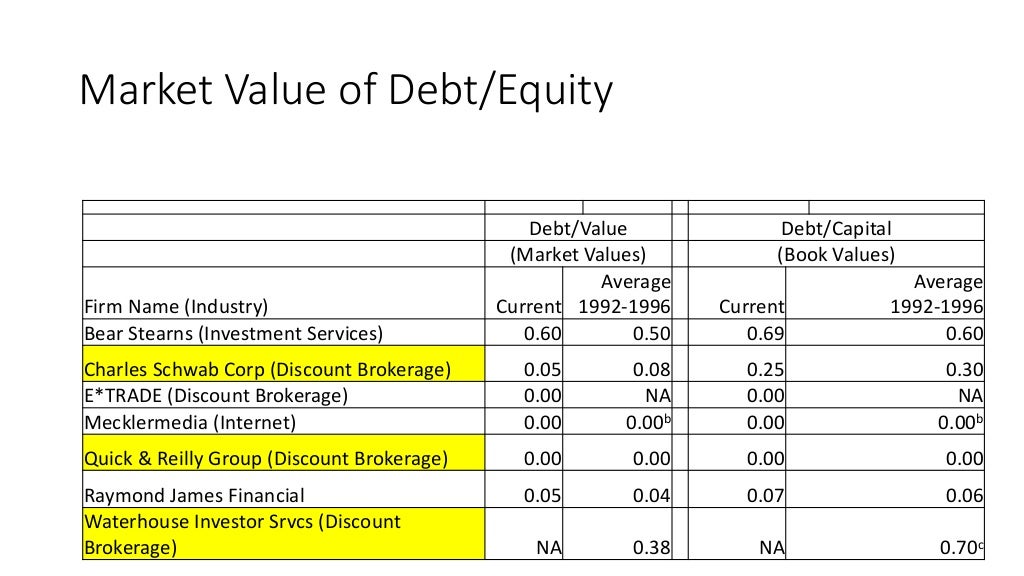

- 4 using the stock price and return data in exhibits 5 and 6 estimate the capm beta

- Vw nyse, amex, and nasdaq

- Cost of capital at ameritrade solution xls

- Ameritrade comparables

Ameritrade case study in 2021

This image demonstrates ameritrade case study.

This image demonstrates ameritrade case study.

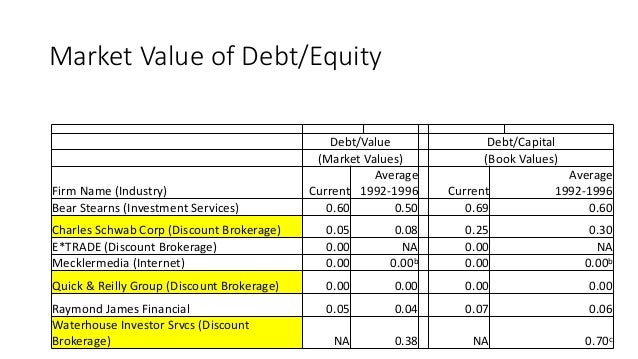

Cost of capital at ameritrade pdf

This image representes Cost of capital at ameritrade pdf.

This image representes Cost of capital at ameritrade pdf.

Cost of capital ameritrade case study solution

This picture representes Cost of capital ameritrade case study solution.

This picture representes Cost of capital ameritrade case study solution.

Ameritrade case study answers

This image demonstrates Ameritrade case study answers.

This image demonstrates Ameritrade case study answers.

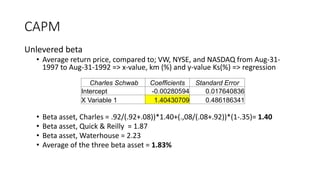

4 using the stock price and return data in exhibits 5 and 6 estimate the capm beta

This image representes 4 using the stock price and return data in exhibits 5 and 6 estimate the capm beta.

This image representes 4 using the stock price and return data in exhibits 5 and 6 estimate the capm beta.

Vw nyse, amex, and nasdaq

This picture representes Vw nyse, amex, and nasdaq.

This picture representes Vw nyse, amex, and nasdaq.

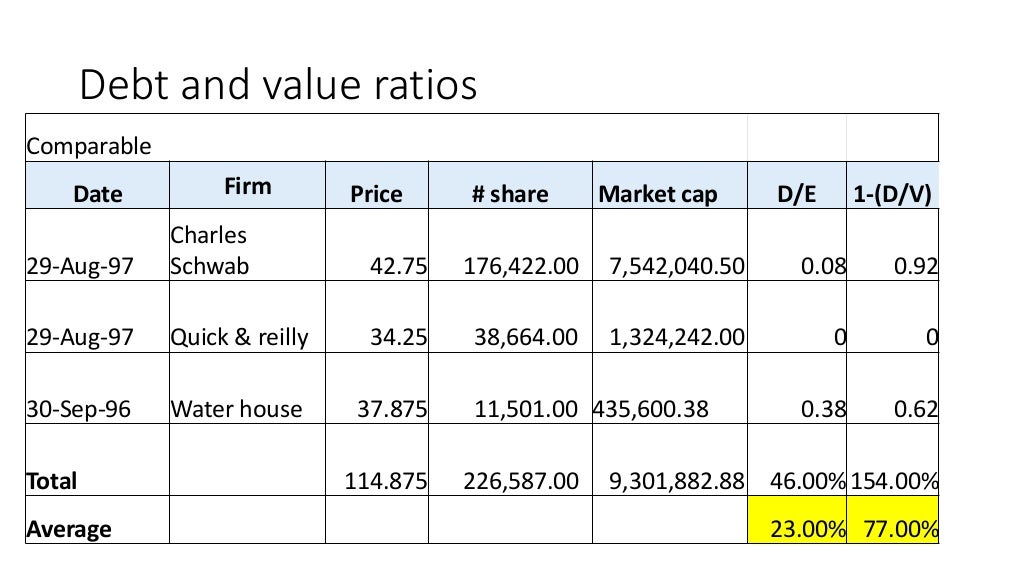

Cost of capital at ameritrade solution xls

This picture demonstrates Cost of capital at ameritrade solution xls.

This picture demonstrates Cost of capital at ameritrade solution xls.

Ameritrade comparables

This picture representes Ameritrade comparables.

This picture representes Ameritrade comparables.

What is the cost of capital for Ameritrade?

Currently, the CEO of the company uses a cost of capital of 15% to analyze the projects, however the company’s management believes the cost to be around 8-9% and the research analysts suggest it to be around 12%. The major problem faced by the company is the disagreements on the cost of capital to be used in project appraisals for the company.

How big is the Ameritrade market risk premium?

6. CAPM Market risk premium Ameritrade is a large company • Historic average total returns on US government securities and common stocks.

What do you need to know about Ameritrade?

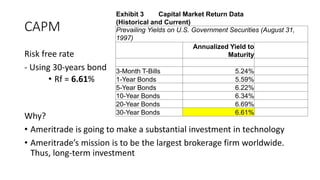

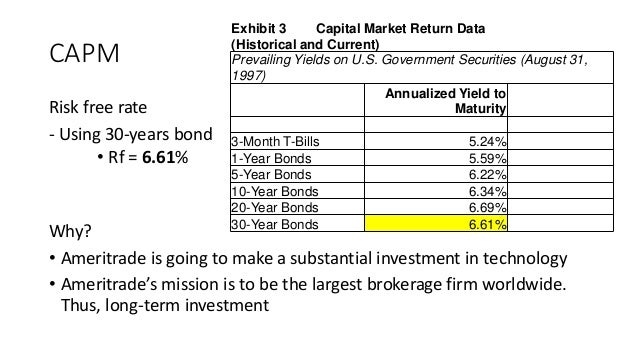

Company Background • Ameritrade is forms in 1971 • Pioneer in the deep-discount brokerage • In Mar 1997, Ameritrade raised $22.5 million in IPO 4. CAPM – Capital Asset Pricing Model • Ke = Rf + B ( Rm – Rf) • Risk free rate • Beta • Expected market return • Market risk premium (Rf-Rm) 5. CAPM Risk free rate - Using 30-years bond • Rf = 6.61% Why?

What kind of broker is Ameritrade Holding Corp?

Ameritrade Holding Corp. is a deep-discount brokerage firm, and the management of the firm is currently planning to make large investments in the marketing and technological developments in the firm.

Last Update: Oct 2021